Monetaforge is a Virtual Asset Service Provider that is Registered with and Regulated by the Cayman Islands Monetary Authority with Registration # 2017470. Monetaforge provides Design, Mint, Issue and Administration (DMIA) Services.

Moneta is a privately held holding company registered in the Cayman Islands and parent of Monetaforge.

Monetaforge is a VASP to Tokenize Real World Assets.

Monetaforge is a Virtual Asset Service Provider (VASP) registered with the Cayman Islands Monetary Authority (CIMA) that provides Design, Mint, Issue and Administration (DMIA) of Permissioned Security Tokens that are compliant with US SEC and other jurisdictional regulations.

Monetaforge manages the investor onboarding, including KYC AML and Accredited Investor verifications. Monetaforge blockchain distributions management is secure, accurate and efficient.

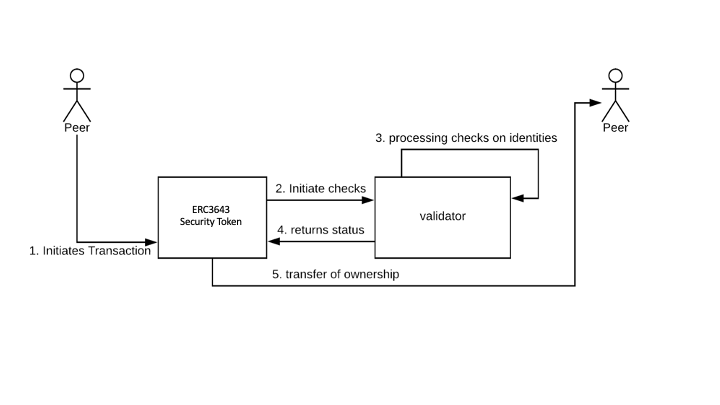

Token holders register with Monetaforge to generate their OnChain ID and qualification permissions to hold a given token by way of the ERC-3643 permissioning standard. Transfer rules engine operating on the blockchain ensures regulation transfer restrictions rule enforcement.

Tokenization of real world assets (RWA) involves representing the ownership rights of real-world assets as digital tokens on a blockchain. Asset tokenization has the potential to bring trillions of dollars of real-world value onto blockchain networks.

Monetaforge DMIA services provide several key advantages to the process of Tokenization.

People

The team of people of Moneta and Monetaforge are experienced professionals brought together to build an ecosystem that will enable key aspects of the global transformation to Digital Assets, ensuring compliance with regulations for both AML/KYC for the issuance of Security Tokens.

Moneta Community

There are many other entities that are part of the Moneta Community, such as Xenia,, Tokeny, Aura Holdings SPC, FTS, Pooley Lake Gold, M3 Helium, Wings of Eagle, and many others soon to be announced.

Some entities are holding companies with asset portfolios that are tokenized. Some entities are crypto loaning or trading companies to help enable asset growth and provide access to finance. Others will include platform or crypto exchange providers.

We hope to build the Moneta Community ecosystem and we welcome participants who can be a valuable contributor to the community.

Moneta and Monetaforge management and staff are committed to conducting all activities with integrity and high ethical standards, ensuring compliance with reglations. We encourage all participants in the Moneta Community to do the same.

On-Boarding

Monetaforge on-boarding system registered token holders to ensure AML/KYC compliance and ensure token issuance in compliance with international regulations.

With an on-Chain ID that is compliant with ERC-3643, an Official Standard for Permissioned Tokens and is an open-source suite of smart contracts that enables the issuance, management, and transfer of permissioned tokens.

Transfer Rules

As a Virtual Asset Service Provider, registered with and regulated by the Cayman Islands Monetary Authority, MonetaForge provides Design, Mint, Issue and Administration (DMIA) services to enable Permissioned Security Tokens, enforcing regulatory (USA SEC and other regulatory jurisdictions) restricted security transfer rules of the tokens via Smart Contracts on the blockchain implementing the industry standard of ERC-3643 and OnChain IDs.

This model ensures enforcement of the USA SEC Reg D 12 month seasoning period restrictions, such as only being able to sell to Accredited Investors in USA. Financial markets, especially private markets, are craving the same level of efficiency, accessibility, and liquidity that is provided by the use of Distributed Ledger Technology (DLT) by utility tokens. However, security tokens cannot be permissionless tokens like utility tokens, which can be transferred to anyone. They must be permissioned tokens in order to track ownership and make sure that only eligible investors can hold tokens, in order to comply with securities laws. The open-source ERC3643 token standard was designed to address the need to support compliant issuance and management of permissioned tokens, that are suitable for tokenized securities, either on a peer-to-peer basis or through regulated trading platforms.

The ERC3643 token standard ensures that an investor cannot become a holder of any digital securities without fulfilling all compliance requirements. Furthermore, regulators can affirm the issuer’s compliance by auditing the smart contracts that underpin the entire life cycle of the security token. This innovation offers a secure, transparent, and efficient environment for managing security tokens while enforcing on-chain compliance.

The main components of the solution are:

- The ONCHAINID, a blockchain based identity management system, allowing for the creation of a globally accessible identity for every stakeholder.

- A set of validation certificates, or verifiable credentials, emitted by trusted third parties and signed on-chain, each of them linked to a single ONCHAINID.

- An Eligibility Verification System (EVS) whose role is to act as a filter of all the transactions of tokenized securities and will check the validation certificates of the stakeholders.

- A set of Compliance rules smart contracts (i.e. offering rules) ensuring that the rules of the offering are respected, e.g. the maximum of tokens held by a single investor, proper accreditations for purchasing, etc.

These 4 key elements allow issuers to use a decentralized Validator to control transfers and enforce compliance on the holders of the security token by utilizing blockchain technology as a registry, proof of ownership, and transfer infrastructure.

Industry Standards

Monetaforge embraces industry standards, such as ERC-3643, an Official Standard for Permissioned Tokens and is an open-source suite of smart contracts that enables the issuance, management, and transfer of permissioned tokens

Deeply Committed

Moneta and Monetaforge are deeply committed to ensuring regulatory compliance is maintained.

Highly Skilled

The Monetaforge team has highly skilled technical and asset management people.